This is part three of the lessons learned from Roger C. Gibson’s book, "Asset Allocation" (Fifth Edition).

Part one is about the impact of inflation. Part two is about the impact of volatility. And part three - this post - is about the impact of diversification.

"Describing an investment only in terms of a two-dimensional world of return and volatility is not sufficient. We also need to describe an investment along a third dimension called the diversification effect." (Gibson)

In particular, he discusses diversification of asset class (not specific equity or bond). Different asset classes may behave differently and with different correlation factor.

And when the asset classes are combined, as a portfolio, the behaviour can be different from each of the component asset classes.

Diversification and performance

He shared, "The typical investor understands that diversification may reduce volatility but suspects that it simultaneously impairs return."

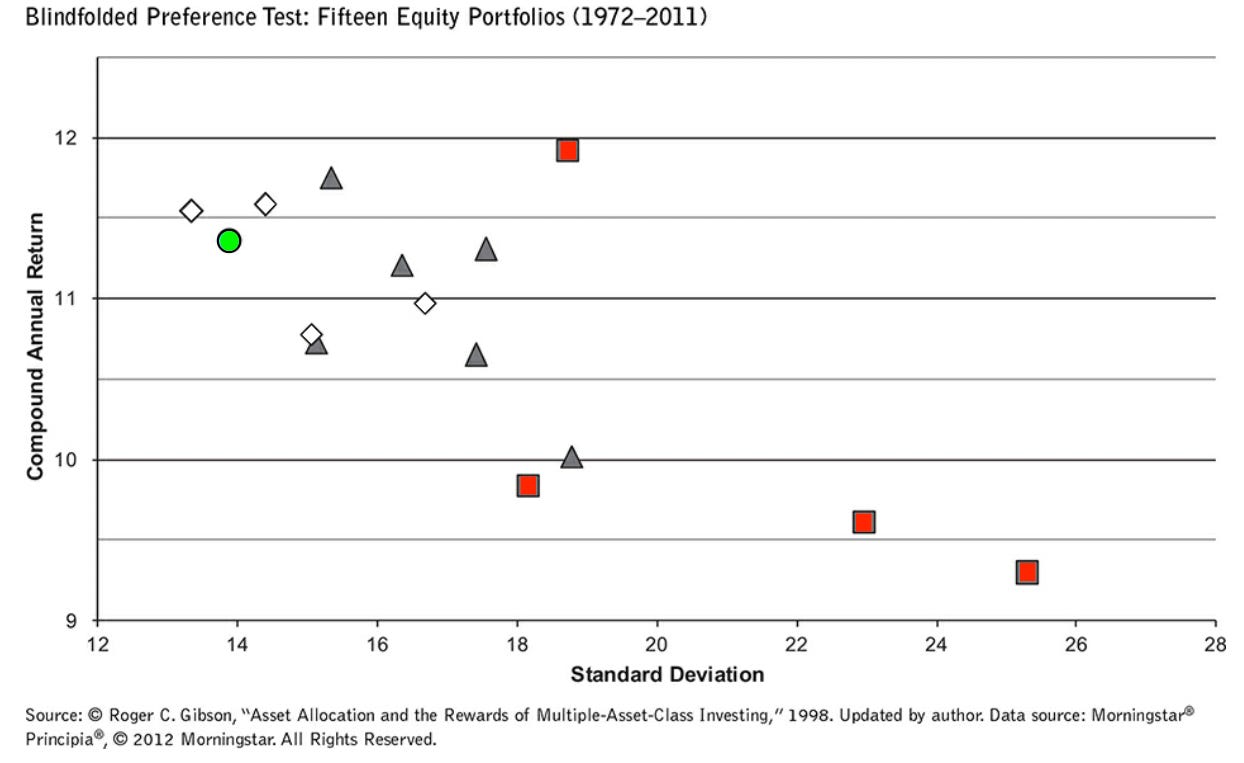

Intuitively this makes sense. To prove otherwise, he gave his "blindfolded" example. Gibson displays a chart for historical performance of various portfolio simulations.

The Y-axis is for the compound annual return. The X-axis is for standard deviation. Lower standard deviation represents lower volatility risk.

For retirement, the aim is to get higher return and lower volatility risk.

Different shapes in the chart represent different asset class combinations. And the combinations are not disclosed yet. Thus the audience is, in essence, "blindfolded".

There are squares, triangles, diamonds, and one circle.

He asks the questions in sequence. If I were to choose between the performance of two shapes, which one would I choose?

First: Randomly chosen square or randomly chosen triangle?

One of the squares has the best return of all simulations. But the other three have the worst return and volatility. The triangles have less volatility and still give good return. The triangles look preferable to me.

Second: Randomly chosen triangle or randomly chosen diamond?

The worst diamond still returns better than the worst two triangles. At the same time, the volatility risk of the diamonds is also lower than the triangles. The combination makes diamonds preferable to me.

Third: Randomly chosen diamond or circle?

Only two triangles beat the circle on returns. And of these two triangles, only one has lower volatility risk than the circle. The diamonds look good, but the circle has the edge.

Through these questions, Gibson guided the audience to focus on the return and the volatility risk. According to him, he gets consistent answers. "People prefers the triangles over the squares, the diamonds over the triangles, and the circle over the diamonds."

And then he took off the "blindfold" and reveal what they are.

The squares are 1-asset-class portfolios

The triangles are 2-asset-class portfolios

The diamonds are 3-asset-class portfolios, and

The circle is a 4-asset-class portfolio.

The lesson learned here is that, built appropriately, over a long period a diversified portfolio can also perform well. And it can do it at lower volatility than less diversified portfolio.

I think that is a good combination.

Diversification takes effort and mental stamina

Beware caveats. The implementation is not as simple as I would have liked.

First: Diversification requires thoughtful planning.

Some diversifications are more beneficial than others. Gibson's book covers the mathematical explanation. You need to do your own proper study.

Second: Diversification requires mental discipline over long investment time horizon.

I highly appreciate Gibson's insight into investor psychology on this topic. It is mentally challenging when our portfolio performs bad when others’ portfolio are doing well on a given year.

The benefit of diversification can only be seen over many years. And there might be years here and there where it may not perform great.

Each year, the multiple-asset-class strategy loses relative to some of its component asset classes and wins relative to others. That is the nature of diversification.

…

Sometimes a new client asks, "Does diversification really work?" I answer, "Yes, it works. But you actually may be asking a different question: That is, will you like diversification? The answer to that question is that sometimes you will, and sometimes you won't."

However, if the time horizon is long, then, to me, it is worth putting in the effort to build a diversified savings portfolio.

Have a great day.

~

Disclaimer: Anything I share is not intended as financial advice; I am merely sharing personal opinions and experiences. The information is of general nature and you should only use it as a place to start your own research and you certainly should do your own due diligence. You ought to seek professional financial advice before making any decisions.