How to save

It starts with budget

Any kind of retirement planning requires savings. And short of a major financial windfall, for many of us, saving up for retirement will take many years.

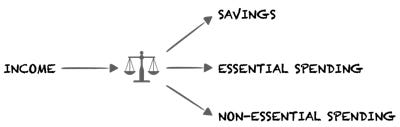

So it helps to have a budget. I learn this from years of tweaking and if I were to start over, below process is how I would do it.

Generally speaking, inflow (on the left) must equal outflow (on the right). This is a key principle to me.

For special large one-time purchase (e.g. home loan, car loan), I may incur debt. Other than that, I try to stay away from debt as best I can.

Savings

Savings here refers to savings in general. It can be retirement savings, kid's college fund, both, etc.

The goal is to consistently move money to the savings / investments account. So savings must be budgeted. Savings should not be what is "left over" in the account.

I plan an amount in the monthly budget and, if there is no financial emergency, then transfer the amount to the savings / investments account.

Budget for savings is important, but it is priority 2 compared to essential spending.

Essential spending

This is subjective. Most of us may agree on a few topics that are essential or non-essential, but there are topics that we will disagree.

For me, essential spending is what I truly need to stay healthy, sheltered, and working to generate income. Your definition may differ and that is fine. To each their own.

During budgeting, essential spending gets priority 1. So it is important that the definition is tight enough.

What if my income barely covers my essential spending? Then I would make major changes in my life to either reduce the essential spending or improve the income. This is very subjective and if it happens, I hope we can get out of it sooner rather than later.

Non-essential spending

By default, non-essential spending is whatever is not in the essential spending budget and not savings.

Non-essential spending is priority 3. It gets what is "left over" that has not been spent on essential spending (priority 1) and savings (priority 2). Also when unplanned / unbudgeted expense is needed, this ought to be financed from the non-essential spending budget rather than the savings budget. Ideally.

But this budget should not be zero. As Robert Fulghum put it (and I paraphrase): we need to budget for joy.

I can live without fun things for a while and save whatever is not consumed on essential spending. Many people do this. But living without joy - long term - is not good for my mental health.

Savings vs non-essential

Let us assume income is greater than essential spending. How much do I save and how much do I spend on non-essentials?

I would start with the end in mind.

Refer to my early post on using a free retirement calculator. The retirement calculator would give a target amount to save. (These calculators target retirement planning, but I can use it to calculate other savings (e.g. for kid's college fund). This would be my starting point. And then I would assess and adapt it.

For example, let us assume that my after tax income is 500,000 🍏 (a hypothetical currency). And assume also that my essential spending totals to 410,000 🍏.

If the retirement savings calculator says I need to save 60,000 🍏, then that becomes the savings budget. That leaves the budget for non-essentials to be 500,000 - 410,000 - 60,000 = 30,000.

And what if the retirement savings calculator says I need to save 120,000 🍏? I only have 500,000 - 410,000 = 90,000 that is available for both savings and non-essentials. In this scenario, I need to adjust.

I can change the retirement scenario that I input into the retirement calculator. This means altering the ideal retirement scenario. Or I can seek extra income by working a second job part time. There are many combinations and this is subjective to you and me.

Or I can budget what I can save for the time being. And work harder on getting a better-paying job and, when I get it, I can increase the budget for savings.

Iterative process

The whole budgeting is not a one-time process. It is iterative and adjustable. It needs review from time to time and, if needed, adjusted according to the most up-to-date circumstances and data.

Depending on personal preference, we can budget at much more detailed level. For me, it is important to start with something that I can execute consistently. And then improve the planning and the tracking with further details if and when the need arises.

Have a great day.

~

Disclaimer: Anything I share is not intended as financial advice; I am merely sharing personal opinions and experiences. The information is of general nature and you should only use it as a place to start your own research and you certainly should do your own due diligence. You ought to seek professional financial advice before making any decisions.