Impact of inflation on retirement

Retirement has long investment time horizon

I just read "Asset Allocation" by Roger C. Gibson (Fifth Edition).

The book is rather dense. It turns out the target audience for the book is the financial advisors, of which I am definitely not. But it is well written and I could follow along. And I am glad I bought this book. It is very educative.

The book explains a lot of topics and one of them is the big picture of risk.

Risks

Prior to this, when I thought about portfolio risk I only thought about volatility. Risk is generally associated to tolerance to potential financial loss. This is generally what the internet talks about. Usually the advice is to save in less and less volatile investments as we get closer to retirement.

The book taught me that I need to view risk from two perspectives.

The two most important [risks in the management of their money] are inflation and portfolio volatility.

The extent to which a portfolio is structured to avoid one of these risks unfortunately exposes it to the other. For this reason, clients must determine which risk is more dangerous to them. Time horizon is the relevant dimension along which clients make this judgement.

For short investment time horizons, volatility is a bigger risk than inflation ... For long investment time horizons, inflation is the more significant danger ...

I want to unpack the first risk: inflation. I will share about volatility in another post.

Inflation does not retire

If I am able to maintain good health, then I may expect to live for a good number of years before I pass away. My retirement savings need to cover my expenses all this time.

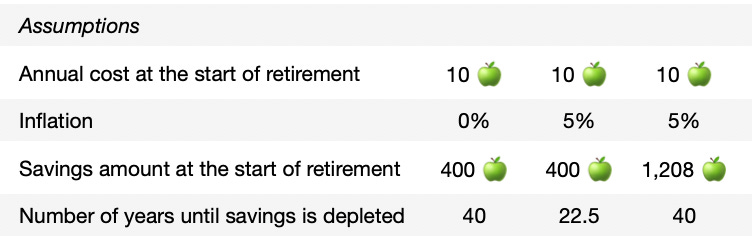

Assume I have 400 🍏 in savings when I retire and my annual cost during retirement is 10 🍏. Assume also, for illustration purpose, that my savings is in a portfolio that does not earn any interest nor gain any capital gain.

It will be enough to cover my retirement for 400 / 10 = 40 years. The savings will probably outlast me. So I will be okay, right?

Maybe not. The above scenario forgot that inflation does not retire.

Inflation makes the purchasing power of the savings less and less every year. If we account for inflation, then the calculation will change. And the higher the inflation is, the worse the impact will be.

Let me update the data for the simulation. Let me add inflation rate of 5% on average every year. (For this example simulation, I use simple average inflation rate as illustration.)

With inflation, my annual cost will increase 5% every year. From 10 🍏 in the first year of retirement to 10.5 in the second year. Subsequently that 10.5 becomes 11.025 in the following year. And then it becomes 11,576 and then 12,155 and then 12,763 and on and on.

If the initial 400 🍏 does not grow, then it is only enough to cover cost + inflation for 22.5 years.

I thought the savings was enough to last 40 years and would outlast me. Accounting for inflation, it turns out it is enough only for 22.5 years. If I remain in good health, I may outlast the savings.

Out of curiosity, I reversed the calculation. How much would I need to have saved to last for 40 years? (Similar to the above illustration, let’s also assume it is not invested in something that generate interest nor capital gain.)

If I assume current cost of 10 🍏 and average inflation of 5%, then how much savings would I need to start my retirement? The answer is 1,208 🍏.

(If you spot an error in the examples above, please email me. Thanks.)

Lesson learned

Inflation fluctuates and differ from country to country. The 5% inflation assumption might be high for some countries (but then 2022 happened). Or this might be laughably low for some countries. It is a data point that is easy to adjust to our local context.

But keep in mind that as long as inflation is not 0%, there is always an impact. Over long investment time horizon, the impact is compounded. The longer the time horizon, the bigger the impact would be.

There are more simulations that I can model and I will. Look for it in a future post. (If you are not a subscriber, you can subscribe now. It is free.)

Have a great day.

~

Disclaimer: Anything I share is not intended as financial advice; I am merely sharing personal opinions and experiences. The information is of general nature and you should only use it as a place to start your own research and you certainly should do your own due diligence. You ought to seek professional financial advice before making any decisions.